Disclaimers

03 Lourensford Road, Stuart’s Hill, Cape Town, 7130

PO Box 8, Fourways, 2055

Phone: 021 203 5468

Mobile: 082 808 0486

Website: www.capvestwealth.co.za

Disclaimers (Annexures to Letter of Disclosure)

- Legal website disclaimers

- Privacy Policy

- Complaints Resolution Policy

- Conflict of Interest Policy (COI)

- Treating a Client Fairly Policy (TCF)

- The Promotion of Access to Information Act (PAIA)

- Protection of Personal Information Act (POPIA)

1. Legal Website Disclaimers

The Financial Advisory and Intermediary Services Act 2002

Capvest Wealth Management (Pty) Ltd (Capvest) is an authorised financial services provider in terms of the Financial Advisory and Intermediary Services Act of 2002. The wealth managers that are employed by Capvest are authorised to provide financial advice. The technical assistants and administrators are not authorised to provide financial advice and do not provide financial advice. All information contained in an email from technical assistants and administrators, including attachments, should not be construed, or relied upon, as advice. If you require financial and/or investment advice, please ensure that you consult with one of our wealth managers.

Ownership

The website is owned and operated by Capvest Wealth Management (Pty) Ltd.

Office address: 03 Lourensford Road, Stuart’s Hill, Cape Town, 7130

Phone: 021 203 5468

Email: [email protected]

Acceptance

By using our website, you agree and accept our Terms and Conditions. The use of this website or any other website which can be accessed from this website is entirely at your own risk and you hereby indemnify us from and against any losses, liability, damages, costs etc. arising out of or in connection with the use of the website or other links on the website.

Copyright

The contents of the website are protected by copyright and other intellectual property laws. Unauthorised copying, circulation or broadcasting is prohibited. All rights not expressly granted are reserved.

Information on this Website – Disclaimer

- The website is controlled by Capvest which is a company established in the Republic of South Africa. The website can be accessed from various countries around the world but is designed specifically for persons located in the Republic of South Africa. No representation or warranty is made that the materials contained in the site are appropriate to and for any other jurisdiction and available in any other jurisdiction. Those who access this site do so on their own initiative and are therefore responsible for compliance with applicable local laws and regulations.

- The information on the website may be used for information and private purposes – not for commercial purposes. The information provided on this website is intended to provide you, the user, with objective information about Capvest’s products and services and is not intended to constitute advice, guidance or proposal as regards the suitability of any product in respect of any need you may have. Calculations made/obtained by means of the tools made available on this website are for illustrative purposes only.

- Further to this, the information, research and content does not represent advice, services, a solution, recommendation, endorsement or offer and therefore you should consult your financial or other advisor should you require advice or financial services.

- Capvest will continue to take reasonable care to ensure that all information provided on this website is true and correct (in so far as this is under its control). The information may contain some inaccuracies or might cater for different interpretations and views. We cannot guarantee that the information is error free, reliable, or complete. There is no warranty of any kind, expressed or implied, regarding the information or any aspect of this service. Any warranty implied by law is hereby excluded except to the extent that such exclusion would be unlawful.

- No variation of the information on the website is allowed and we cannot be held liable in such instances.

- We cannot be held liable for any losses due to cybercrime or viruses through the use of the website.

- The information on the website should not be interpreted as an offer.

- In addition, Capvest is not responsible for and disclaims all liability for any loss, liability, damage (whether direct, indirect or consequential) or expense of any nature whatsoever which may be suffered as a result of, or which may be attributable, directly or indirectly, to the use of or reliance upon any information, links, opinions or services provided through this website. The user hereby indemnifies Capvest and/or its service providers against any claim or liability arising out of the user’s use of this website. The user waives any claim that it may have or acquires against Capvest as a result of the user’s use of this website.

- The Promotion of Access to Information Act, no. 2 of 2000 (the “Act”) gives persons the right of access to information that is required for the exercise or protection of any rights. In order for access to information to be granted, certain requirements have to be met. The Act also required private bodies such as Capvest to compile a manual, designed to assist people who want to exercise their right to access information. This manual, as well as the prescribed request form and fees payable (should you wish to exercise your right of access to information), can be obtained by emailing us at [email protected].

Electronic Communications

Consent

By communicating with us through electronic means, you consent to receive communications electronically and agree that all agreements, notices, disclosures and all other communications transmitted by electronic means, satisfy any legal requirement, including but not limited to the requirement that such communication should be in writing. Unless otherwise agreed, we are only deemed to have received an email once we have confirmed receipt thereof; and we are only deemed to have sent an email once reflected as ‘sent’ on our email server.

Confidentiality warning

The contents of emails and any accompanying documentation are confidential and may be subject to legal privilege and client confidentiality. Any use thereof, in whatever form, by anyone other than the addressee is strictly prohibited. If you are not the intended recipient of an email or facsimile, kindly notify the sender by return email, facsimile or telephone, and delete it from your system. You may not copy an email or disclose its contents to any other person, without our express written consent.

Personal use by employees

Capvest Wealth Management (Pty) Ltd is not able to distinguish between business and personal emails. Users who make use of Capvest’s email system do so at their own risk and accept responsibility for any actions or consequences that arise from such personal use. Any views or opinions expressed in such messages are those of the individual sender and do not create obligations on or represent any commitment by Capvest, except where the sender specifically states it to be the views or opinions of Capvest. If this message contains offensive, derogatory or defamatory statements or materials, it means the message has been sent outside the sender’s scope of employment with Capvest and only the sender can be held liable in his/her personal capacity.

Interception and monitoring

In general terms, Capvest does not engage in blanket monitoring of communications. Capvest does however reserve the right at any time and without notice to intercept and monitor communications and stored files sent or received over or stored on Capvest’s information and communications systems, provided that such monitoring and interception is: performed by a Capvest representative properly authorised by Capvest, for lawful purposes, and strictly in accordance with the Capvest Information Policy procedures.

Links to Third-Party Sites

The website has hypertext links to websites of third parties. We do not take responsibility for the content, information, services, etc. of the third parties. Discretion should be used when accessing the third-party links. We encourage users to be aware when they leave our site and to read the privacy statements for each and every website that collects personally identifiable information. The privacy statement applies solely to information collected by this website.

Governing Law

The Laws of the Republic of South Africa apply.

2. Privacy Policy

Capvest Wealth Management (Pty) Ltd (Capvest) is committed to maintaining the privacy and security of its clients’ and associates’ personal and private information. Our Privacy Policy outlines our practices and commitment to the customer and is confirmed below.

In general, when using our website, you will not have to divulge personal information by yourself. However, while using the website, you may provide personal information about yourself or Capvest may collect some of your personal information.

Further to this, third parties might request some of your personal information from Capvest, which we may refuse. The Promotion of Access to Information Act, 2000 (“PAIA”) regulates such requests. Please refer to our PAIA Manual for more information about this.

This use and disclosure of your personal information

This is regulated by the Protection of Personal Information Act (“PPI”). We collect and process your personal information mainly to provide you with access to our services, to help us improve our offerings to you and for certain other purposes explained below.

The type of information we collect will depend on the purpose for which it is collected and used. We will only collect information that we need for that purpose.

We collect information directly from you where you provide us with your personal details, for example when we do your planning, prepare a proposal, when you submit enquiries to us or contact us. Where possible, we will let you know what information you are required to provide to us and what information is optional.

With your consent, we may also supplement the information that you provide to us with information we receive from other companies (e.g. Astute or other investment houses) to offer you a more consistent and personalised experience with Capvest.

Website usage information is collected using “cookies” which allows us to collect standard internet visitor usage information.

We will use your personal information only for the purposes for which it was collected or agreed with you, for example:

- To provide our services to you, to carry out the transaction you requested and to maintain our relationship;

- For underwriting purposes;

- To assess and process claims;

- To confirm and verify your identity or to verify that you are an authorised user for security purposes;

- For the detection and prevention of fraud, crime, money laundering or other malpractice;

- To conduct market or customer satisfaction research or for statistical analysis;

- For audit and record-keeping purposes;

- In connection with legal proceedings.

We will also use your personal information to comply with legal and regulatory requirements or industry codes that we subscribe to, or which apply to us, or when it is otherwise allowed.

Given our aim to provide you with ongoing wealth management services, we would like to use your information to keep you informed about other financial products and services which may be of particular interest to you and to contact you to setup review meetings.

We may disclose your personal information to our service providers who are involved in the delivery of products or services to you. We have agreements in place to ensure that they comply with these privacy terms.

Sharing of personal information

We may share your personal information with, and obtain information about you from:

- Third parties for the purposes listed above, for example, credit reference and fraud prevention agencies, law enforcement agencies;

- Other insurers to prevent fraudulent claims;

- Other third parties from whom you have chosen to receive marketing information;

- Where we have a duty or a right to disclose in terms of law or industry codes;

- Where we believe it is necessary to protect our rights.

Updating of personal information

you have the right to ask us to update, correct or delete your personal information. You may do this by contacting us at the numbers or addresses provided below.

We will take all reasonable steps to confirm your identity before making changes to your personal information we may hold about you.

Security of information

Capvest takes all reasonable steps to protect your personal information.

Please note that we may amend these guidelines from time to time. Please check this website periodically to keep yourself informed if our guidelines change.

3. Complaints Resolution Policy

Capvest Wealth Management (Pty) Ltd (Capvest) has a detailed internal complaint resolution procedure to assist in resolving complaints.

Should you wish to pursue a complaint against a key individual or representative of Capvest you should address the complaint in writing to us by emailing [email protected].

If you cannot settle the complaint with us, you are entitled to refer it to the Office of the FAIS Ombud, at [email protected] or telephone number 0860 324 766. The ombud has been created to provide you with a redress mechanism for any inappropriate financial advice that you feel may have been given to you by a financial advisor.

Where do I submit a complaint?

03 Lourensford Road, Stuart’s Hill, Cape Town, 7130

PO Box 8, Fourways, Johannesburg, 2055

Telephone: 021 203 5468

Cell Phone: 082 808 0486

Email: [email protected]

Information to provide to register a complaint

Name

Date of Complaint

Date of Service Received

Service Provider

Type Product

Policy or Investment Number

Person Dealing with at Capvest

Your Contact Details

Description of Complaint

Purpose

The FAIS General Code of Conduct requires that a Financial Services Provider (FSP) must establish, maintain and operate an adequate and effective Complaints Management Framework to ensure the effective resolution of complaints and the fair treatment of complainants.

Treating Customers Fairly (TCF) Outcome 6 provides that “Customers do not face unreasonable post-sale barriers imposed by firms to change a product, switch providers, submit a claim or lodge a complaint”. This document provides a complaints procedure in conformance with legislative expectations and sets out the process that the FSP will follow in order to resolve the complaint.

Objectives

The Complaints Management Framework sets out the approach that Capvest Wealth Management (Pty) Ltd is taking to manage complaints in order to mitigate business and client risks and achieve compliance with the FAIS Act and subordinate legislation. The FSP is committed to ensuring that appropriate measures are in place to enable the FSP to investigate and resolve any complaints received with due regard to the fair treatment of customers.

The Complaints Management Framework aims to assist our staff to apply a consistent, high-quality, fair, and accountable response to complaints.

All complaints will be treated in line with the overall regulatory requirements and Treating Customer Fairly outcomes.

Key definitions

The definitions relating to Complaints Management as defined in the FAIS General Code of Conduct as amended on 26 June 2020 are listed in Annexure A.

Components

Our most valuable asset is our clients. We, therefore, strive to maintain a positive attitude towards the discussion of problems and queries and continuous improvement. We value our clients’ feedback and are committed resolving any complaints in a quick, fair, efficient and courteous manner.

Our Complaints Management Framework is made up of different components that address measures to achieve the effective resolution of complaints and the fair treatment of complainants.

Capvest Wealth Management’s (Pty) Ltd Complaint Management Framework is designed in line with Treating Customers Fairly outcomes and consists of the following:

- Complaints Management Policy

- Complaints register

Review

Capvest Wealth Management (Pty) Ltd undertakes to review its Complaints Management Framework and document the changes thereto on a bi-annual basis, alternatively whenever there are changes in the business that impact the Complaints Management Framework. A review register is set out in Annexure B.

Anton Meyer is responsible for reviewing and updating the Complaints Management Framework.

Allocation of responsibilities

Anton Meyer is responsible for making decisions or recommendations in respect of complaints received within the FSP.

Categorisation of complaints

Prescribed minimum categories

At a minimum, the following categories will be used to categorise complaints:

Complaints relating to:

- The design of a financial product, financial service, or related service, including the fees, premiums or other charges related to that financial product or financial service.

- Information provided to clients.

- Financial product or financial service performance.

- A service to clients, including complaints relating to premium or investment contribution collection or the lapsing of a financial product.

- Financial product accessibility, changes or switches, including complaints relating to redemptions of Investments.

- Complaints handling.

- Insurance risk claims, including non-payment of claims.

- Other complaints.

Procedure

Capvest Wealth Management (Pty) Ltd will follow the process below for the appropriate categorisation of complaints. This will be based on risk associated with the claim, as well as TCF outcomes and its impact on a customer.

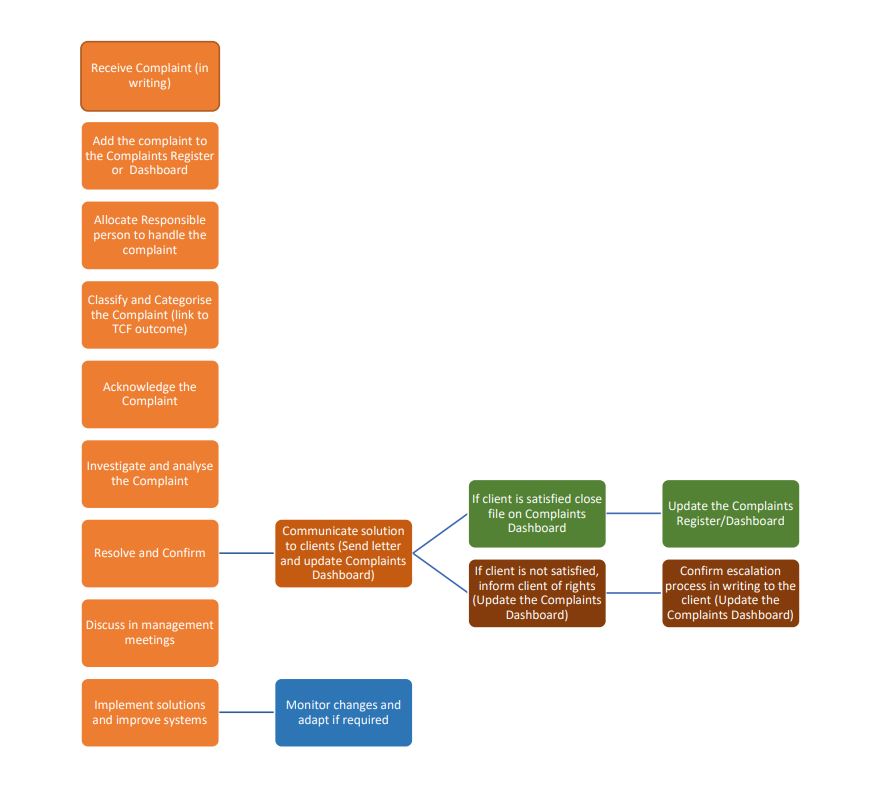

Complaints resolution process

Process Step | Step Details |

1. Lodge/Receive a Complaint | · The client is to submit the complaint to the FSP in writing to the contact details that appear in the Complaints Management Framework. The complaint can be submitted by hand, post, fax or email. · If a complaint is submitted telephonically, the FSP will send the client an email to request the relevant details regarding the complaint. The client needs to respond and provide the requested information in writing (e.g. hand, post, fax or email). · The client must submit sufficient details of the complaint, this includes their: o Name and surname o Policy number o ID number o Postal address o Financial advisor o Product supplier o Product type: risk, investment, short term, endowment, employee benefits, disability, medical aid, unit trust, wills etc o Complaint category: product features and charges, information disclosures, advice, product performance, client services, access, changes or switches, complaints handling, claims, or other complaints o Brief detail of the complaint |

2. Acknowledge | The FSP will: · Acknowledge all complaints within 24 hours of receipt. · Clearly and transparently communicate the availability and contact details of the relevant ombud services to complainants (clients) at all relevant stages of the relationship with a client, including at the start of the relationship and in relevant periodic communications. · Ensure all communication with a complainant is in plain language. · Provideclients, where feasible, with a single point of contact for submitting complaints. · Promptly inform a complainant of the process to be followed in handling the complaint, including: o Contact details of the person or department that will be handling the complaint; o Indicative and, where applicable, prescribed timelines for addressing the complaint; o Details of the internal complaints escalation and review process if the complainant is not satisfied with the outcome of a complaint; o Details of escalation of complaints to the office of a relevant ombud and any applicable timeline; and o Details of the duties of the provider and rights of the complainant as set out in the rules applicable to the relevant ombud. · Follow up telephonic acknowledgments with a written response either by SMS or email. · Despatch a complaint reference number to the complainant on the acknowledgment of the complaint. · Disclose to the client: o The type of information required from a complainant; o Where, how and to whom a complaint and related information must be submitted; o Expected turnaround times concerning complaints; and o Any other relevant responsibilities of a complainant. · Despatch the details of the person allocated to the complaint to the complainant within 48 hours from receipt. |

3. Allocate a Responsible Person | The FSP will ensure that: · The complaint is allocated and dealt with by a trained staff member. · The person responsible for the clients’ complaint will furnish the client with his or her contact details and the reference number of the complaint (if applicable). · The complaints manager or key individual has oversight over the complaints allocated to Yzelle Reynolds. |

4. Classify | The FSP will: · Ensure that all potential issues are captured and classified for escalation, review, and action, as required. · Reduce any complaint, issue or negative client interaction to writing then log and classify for action. · Where a third party is acting on behalf of a complainant, the FSP will ensure that such third party delivers a certified or original consent or power of attorney to act on behalf of a complainant: o No further dealings will be pursued with such a third party until the proper authority is obtained; however o The complaint will be taken up directly with the complainant on whose behalf the complaint is made. · Formally log all complaints using a relevant process or complaints register (whether manual or via computer database system).

Risk All complaints will be prioritised as follows:

Risk 1 – These are routine complaints with potentially low business impact.

Routine complaints: · Require a response to the client within 15 working days. · Have the potential of becoming serious or official complaints if disregarded or ignored by the FSP. · Require staff to review the complaint and its priority with the complaints manager or key individual before proceeding to the next step. · Requires the complaints manager or key individual to decide on the appropriate person(s) to carry out subsequent steps, including the investigation.

Risk 2 – These complaints are urgent and can have a serious business impact. Serious complaints: · Require a response to the client within 5 to 10 working days. · Are logged on media platforms, received from legal advisors or immediately evidence of contravention of legislation requirements such as failure to conduct a proper needs analysis. · Can cause reputational harm to a business and/or may cause financial loss to a client. · Need to be handled by the complaints manager or key individual or a suitable senior person delegated to the task by the complaints manager or key individual. Yzelle Reynolds will perform this function. · Complaints received from third parties and/or legal advisors will be responded to within 24 hours: o Acknowledge receipt of the complaint; o Further requesting authority to act on the complainant’s behalf such as a power of attorney or consent by the complainant to deal with the complaint on the complainant’s behalf.

No information will be divulged to a third party who does not have the proper authority to act on a complainant’s behalf.

Risk 3 – These are urgent official complaints received from authorities e.g. FAIS Ombud.

Urgent official complaints: · Are handled by the complaints manager or key individual. Yzelle Reynolds will perform this duty. Alternatively, the investigation of the complaint may be delegated to a suitable senior person selected by the complaints manager or key individual. · The required draft response and attachments will be collated by this senior person. · The complaints manager or key individual is responsible for compiling the response to the authority. · The response to the authority will be made within the stipulated turnaround time stated on the official correspondence. |

5. Categorisation | The FSP will categorise reportable complaints as per the following minimum categories: · The design of a financial product, financial service, or related service, including the fees, premiums, or other charges related to that financial product or financial service. · Information provided to clients. · Advice given to clients. · Financial product or financial service performance. · Service to clients, including those relating to premium or investment contribution collection or lapsing of a financial product. · Complaints handling. · Insurance risk claims which include non-payment of claims. · Other complaints can be additional categories relevant to the FSPs chosen business model, financial products, financial services, and client base that will support the effectiveness of its Complaints Management Framework in managing conduct risks and effecting improved outcomes and processes for its clients.

Group the complaints The FSP will thereafter: · Categorise, record, and report on reportable complaints by identifying the category to which a complaint closely relates and group complaints accordingly. · Narrow down the categories to the impact on clients. · Measure the impact of the complaint by further categorising it according to the following TCF Outcomes:

TCF Outcome 1 Includes complaints: · Other complaints relating to management issues.

TCF Outcome 2 Includes complaints: · Relating to the design of a product or service. · Relating to product features and charges that affect this TCF outcome.

TCF Outcome 3 Includes complaints: · relating to unsuitable or inaccurate, misleading, confusing, or unclear information provided to a client throughout the life cycle of a product · FSP to include the Conflict of Interest disclosures required by the FAIS General Code of Conduct (Code); Section 4 and 5 of the Code or any other disclosure requirements in terms of the Code or any other legislation in these disclosures

TCF Outcome 4 Includes complaints: · Relating to the advice given to a client by an advisor that was misleading, inappropriate, and/or tainted with conflicts of interest that were not disclosed. · Concerning inappropriate advice given as a result of lack of knowledge, skill, or experience on the part of the advisor of the product or service being rendered. · Regarding failure to conduct a needs analysis and to consider the clients’ financial position, goals, or life stage.

TCF Outcome 5 Includes complaints: · About product performance and service-related issues. · Relating to a client’s disappointment with limitations in a product or service performance of which they were unaware. · Relating to the inability of a product to meet a client’s expectations. · Related to a product supplier’s exercise of a right to terminate a product or amend its terms.

TCF Outcome 6 Includes complaints: · Relating to product accessibility, changes or switches. · Relating to handling and complaints relating to claims.

|

6. Investigate | The FSP will: · Analyse the root cause of the complaint to enable the complaint to be appropriately dealt with and avoid, if possible, its re-occurrence. · Identify and clarify internal and external key facts. · Escalate complaints relating to product features or services handled solely by a product supplier. · Whenever a complaint is escalated or reviewed ensure that: o A balanced approach is followed, bearing in mind the legitimate interests of all parties involved including the fair treatment of clients; o Internal escalation of complex or unusual complaints at the instance of the initial complaint handler is provided for; o Clients may escalate complaints not resolved to their satisfaction; o The escalation is allocated to an impartial, senior functionary within the provider or appointed by the provider for managing the escalation or review process of the provider. · Ensure that procedures within the complaints escalation and review process are not overly complicated or impose unduly burdensome paperwork or other administrative requirements on complainants (clients). · Document all areas of interaction and communication. · Ensure accurate, efficient and secure recording of complaints and complaints-related information. · In respect of each reportable complaint, keep a record of: o All relevant details of the complainant and the subject matter of the complaint; o Copies of all relevant evidence, correspondence and decisions; o The complaint categorisation; o The progress and status of the complaint, including whether the progress is within or outside any set timelines. · Concerning reportable complaints categorised on an ongoing basis record the number of complaints: o Received o Upheld o Rejected and their reasoning o Escalated by complainants (clients) to the internal complaints escalation process o Referred to an ombud and their outcomes o And amounts of Compensation payments made o And amounts of goodwill payments made o The total number of complaints outstanding · Ensure complaints information recorded is scrutinised and analysed on an ongoing basis and utilised to manage conduct risks and effect improved outcomes and processes for clients, and to prevent recurrences of poor outcomes and errors. · Obtain consent from the complainant to ensure that no personal information is divulged or processed without the complainant’s knowledge or consent. · Keep the complainant appropriately updated on the progress of the investigation. |

7. Resolve and Confirm | The FSP will: · Ensure that the proposed resolution meets the Treating Customers Fairly Outcomes, does not prejudice the FSP or the complainant, and does not involve any unnecessary legal or financial implications. · Document and assess the proposed action agreed upon with the complaints manager and/or affected key individual and representative. · Discuss and review the signed-off resolution with the complainant to ensure fairness and clarity and to further ensure that the resolution deals with the root cause of the complaint. · Include recognition and documentation of any underlying issues that have contributed to the complaint and recommendations for actions to prevent further occurrence in the review.

|

8. Respond to Client | The FSP will: · Ensure the complaint process is accessible through channels that are appropriate to the FSP’s clients. · Ensure there are no charges for making use of the complaint process. · Ensure communication is in plain language. · Clearly explain the details of the findings and proposed resolution to the client – within the agreed timeframes. · Where a complaint is upheld, if there has been any commitment by the FSP to make a compensation payment, goodwill payment, or to take any other action ensure it is carried out without undue delay and within the agreed timeframes. · Where a complaint is rejected, the complainant must be provided with clear and adequate reasons for the decision and must be informed of any applicable escalation or review processes, including how to use them and any relevant time limits. · Send a written acknowledgment of the complaint to the complainant, with contact details of the FAIS Ombud, if the complaint cannot be addressed within three weeks and a single point of contact for submitting complaints.

If within six weeks of receipt of a complaint the FSP has been unable to resolve the complaint to the satisfaction of a complainant, the complainant may refer the complaint to the Office of the FAIS Ombud if he or she wishes to pursue the matter and the complainant must do so within six months of the receipt of such notification. Appropriate processes for engagement with the ombud. |

9. Follow Up and Review | The FSP will: · Diarise complaints to ensure they remain within the appropriate turnaround times. · Keep complainant appropriately informed of the progress of their complaint. · Keep complainant appropriately informed of causes of any delay in the finalisation of a complaint and revised timelines, should a complaint exceed the turnaround time due to unforeseen and reasonable circumstances. · Keep the complainant appropriately informed throughout the complaints process of the resolution being sought. · Conduct a follow-up on the resolution of the complaint, to ascertain whether the client was satisfied with the complaints-handling process and the resolution sought and whether the resolution was proper and fair. · Action any negative responses in the review of complaints. |

10. Quality Assurance and Close | The FSP will: · Ensure the board of directors, governing body, complaints manager or key individual ensures that all employees of the business have access to the Complaints Management Framework. · Ensure the board of directors, governing body, complaints manager, or key individual approves and oversees the effectiveness of the implementation of the Complaints Management Framework. · Ensure the responsible person, making a decision or recommendation is adequately trained, has an appropriate mix of experience, knowledge, and skills in complaints handling, fair treatment of customers, subject matter concerned, relevant legal and regulatory matters also not subject to conflict of interest and be adequately empowered to make impartial decisions or recommendations. · Ensure clients will be made aware of the Complaints Management Framework and will have access to the manual upon request. · All complaints will be reviewed monthly and will be used as TCF Management Information to improve overall TCF outcomes. · Action all complaints to prevent re-occurrence of poor outcomes and errors, where feasible. · Ensure complaints are scrutinised and analysed on an ongoing basis. · Ensure complaints are utilised to manage conduct risks. · Ensure complaints effect improved outcomes and processes for its clients · Update the complaints register. · Ensure compliance with any prescribed requirements for reporting complaints information to any relevant designated authority or the public as may be required by the Registrar. · Close the matter. |

Representatives and suppliers

Capvest Wealth Management (Pty) Ltd has a process for managing complaints relating to our representatives and service suppliers.

We are performing an annual due diligence on all our service providers. Our service providers have a comprehensive Complaints Management Processes in place and have implemented TCF policies.

We prefer to be fully involved in the process. We manage the complaints process to ensure that the outcome is beneficial to all parties. We want to serve as a link between customers and product suppliers.

We have extensive business processes to ensure that clients are always very well informed on every step

Decisions relating to complaints.

Capvest Wealth Management (Pty) Ltd undertakes to ensure that:

- Where a complaint is upheld, any commitment by the FSP to make a compensation payment, goodwill payment or to take any other action will be carried out without undue delay and within any agreed timeframes.

- Where a complaint Is rejected, the FSP will provide the complainant with clear and adequate reasons for the decision and inform the complainant of any applicable escalation or review processes, including how to use them and any relevant time limits.

Complaints escalation and review process

Capvest Wealth Management has an internal complaints escalation and review process:

- We use Atwork to manage and diarise every query. Please refer to the Complaints Resolution Process for the timeframes.

- Yzelle Reynolds is responsible for managing the escalation and review process of complaints.

- Where a complaint requires escalation or review, the complaint will be referred to Anton Meyer.

- Complaints may be escalated and/or reviewed in the following instances:

- Where the complaint is of a complex or unusual nature. In such an instance the initial complaint handler may escalate the complaint;

- Complainants may escalate complaints that were not resolved to their satisfaction (complainants must be notified of this).

Record-keeping, monitoring and analysis

Capvest Wealth Management (Pty) Ltd has business processes in place to ensure accurate, efficient and secure recording of complaints and complaints-related information. We have implemented a complaints register.

We record the following:

- All relevant details of the complainant and the subject matter of the complaint.

- Copies of all relevant evidence, correspondence, and decisions.

- The complaint categorisation.

- Progress and status of the complaint, including whether such progress is within or outside any set timelines.

We maintain the following data, on categorised reportable complaints, on an ongoing basis:

- number of complaints received

- number of complaints upheld

- number of rejected complaints and reasons for the rejection

- number of complaints escalated by complainants to the internal complaints escalation process

- number of complaints referred to an ombud and their outcome

- number and amounts of compensation payments made

- number and amounts of goodwill payments made

- total number of complaints outstanding

We analyse the information gathered on an ongoing basis, using this information to manage conduct risks and implement improved outcomes and processes for our clients to prevent recurrences of poor outcomes and errors.

We have detailed processes in place to establish and maintain appropriate processes for reporting the information to our governing body:

- We use Atwork CRM System as well as our Google Drive for record-keeping, monitoring and analysing of complaints.

- The monitoring and analysis of complaints will be reported to Anton Meyer on a weekly basis. The report will include:

- Information on the categorisation of complaints;

- What risks have been identified since the last report;

- What trends have been identified;

- What actions will be taken to manage risks and implement improved outcomes.

- The FSP will keep records of these reports, monitor changes and consider whether the Complaints Management Framework may need to be adapted in response to the findings.

- Responsible person/s.

Yzelle Reynolds will be responsible for the recordkeeping requirements, monitoring requirements and analysis requirements.

Communication with complainants

We will ensure that (in line with TCF):

- Our complaint processes and procedures are transparent, visible and accessible through channels that are appropriate to the provider’s clients.

- It does not impose any charge for a complainant to make use of complaint processes and procedures.

- All communications with a complainant will be in plain language.

- Wherever feasible, it will provide clients with a single point of contact for submitting complaints.

- The following information is disclosed to a client:

- The type of information required from a complainant;

- Where, how and to whom a complaint and related information must be submitted;

- Expected turnaround times in relation to complaints;

- Any other relevant responsibilities of a complainant.

- Within a reasonable time after receipt of a complaint, it will acknowledge receipt thereof and promptly inform a complainant of the process to be followed in handling the complaint including:

- Contact details of the person or department that will be handling the complaint;

- Indicative and, where applicable, prescribed timelines for addressing the complaint;

- Details of the internal complaints escalation and review process if the complainant is not satisfied with the outcome of a complaint;

- Details of escalation of complaints to the office of a relevant ombud and any applicable timeline;

- Details of the duties of the provider and rights of the complainant as set out in the rules applicable to the relevant ombud.

- Complainants will be kept adequately informed of:

- The progress of their complaint;

- Causes of any delay in the finalisation of a complaint and revised timelines; and

- The FSP’s decision in response to the complaint.

Engagement with ombud and reporting

We undertake to:

- Ensure there is an appropriate process in place for engagement with any relevant ombud concerning its complaints.

- Clearly and transparently communicate the availability and contact details of the relevant ombud services to complainants at all relevant stages of the relationship with a client, including at the start of the relationship and in relevant periodic communications.

- Display and/or make available information regarding the availability and contact details of the relevant ombud services, at the premises and/or on the company website

- Maintain specific records and carry out specific analysis of complaints referred to your business by the ombud and the outcomes of such complaints.

- Monitor determinations, publications, and guidance issued by any relevant ombud to identify failings or risks in their policies, services, or practices.

- Maintain open and honest communication and co-operation between itself and any ombud with whom it deals.

- Endeavour to resolve a complaint before a final determination or ruling is made by an ombud, or through the business’ internal escalation process, without impeding or unduly delaying a complainant’s access to an ombud.

The FSP will follow the process below when engaging with an ombud or reporting to designated authority:

Step 1 – FSP receives a complaint from the office of the ombud

- Respond to the ombud acknowledging receipt and confirm that a full response will be sent to the ombud within six weeks

- Record the date of receipt

- Record the ombud case manager’s name

Step 2 – FSP records complainant details

- Record the name of the complainant

- Record the policy number

- Record the case number or ombud reference

- Acknowledge receipt of the complaint to client

Step 3 – FSP records claim information

- Record the claim amount or issue

- Record the reason for the complaint

- Gather information and documentation to submit to the ombud

Step 4 – FSP informs PI scheme

- Inform your PI scheme of the potential claim

Step 5 – FSP responds to ombud

- Provide reasons and feedback to the ombud of the steps you will take to rectify the situation

OR

- If you are not in agreement with the facts the client has provided, submit your version of events and include documentation to support this

Step 6 – The ombud replies to FSP with a recommendation in terms of s27(4)

Step 7 – FSP responds to the ombud’s recommendation

- Respond to the ombud within two weeks of receipt

Step 8 – Ombud decision

- If the ombud agrees with the FSP, the ombud will finalise the case and provide a determination

- If the ombud is not in agreement, the ombud will engage further with the FSP so they can delve deeper into the matter in order to make a decision and arrive at a determination

Annexure A – Definitions

“Client query” means a request to the provider or the provider’s service supplier by or on behalf of a client, for information regarding the provider’s financial products, financial services or related processes, or to carry out a transaction or action in relation to any such product or service.

“Complainant” means a person who submits a complaint and includes a –

- client;

- person nominated as the person in respect of whom a product supplier should meet financial product benefits or that person’s successor in title;

- person whose life is insured under a financial product that is an insurance policy;

- person that pays a premium or an investment amount in respect of a financial product;

- member;

- person whose dissatisfaction relates to the approach, solicitation marketing or advertising material or an advertisement in respect of a financial product, financial service or related service of the provider, who has a direct interest in the agreement, financial product or financial service to which the complaint relates, or a person acting on behalf of a person referred to in (a) to (f).

“Complaint” means an expression of dissatisfaction by a person to a provider or, to the knowledge of the provider, to the provider’s service supplier relating to a financial product or financial service provided or offered by that provider which indicates or alleges, regardless of whether such an expression of dissatisfaction is submitted together with or in relation to a client query, that –

- the provider or its service supplier has contravened or failed to comply with an agreement, a law, a rule, or a code of conduct that is binding on the provider or to which it subscribes;

- the provider or its service supplier’s maladministration or wilful or negligent action or failure to act, has caused the person harm, prejudice, distress or substantial inconvenience; or

- the provider or its service supplier has treated the person unfairly.

“Compensation payment” means a payment, whether in monetary form or in the form of a benefit or service, by or on behalf of a provider to a complainant to compensate the complainant for a proven or estimated financial loss incurred as a result of the provider’s contravention, non-compliance, action, failure to act, or unfair treatment forming the basis of the complaint, where the provider accepts liability for having caused the loss concerned, but excludes any –

- goodwill payment;

- payment contractually due to the complainant in terms of the financial product or financial service concerned; or

- refund of an amount paid by or on behalf of the complainant to the provider where such payment was not contractually due;

- and includes any interest on late payment of any amount referred to in (b) or (c).

“Goodwill payment” means a payment, whether in monetary form or in the form of a benefit or service, by or on behalf of a provider to a complainant as an expression of goodwill aimed at resolving a complaint, where the provider does not accept liability for any financial loss to the complainant as a result of the matter complained about.

“Member” in relation to a complainant means a member of a –

- pension fund as defined in section 1(1) of the Pension Funds Act, 1956 (Act 52 of 1956);

- friendly society as defined in section 1(1) of the Friendly Societies Act, 1956 (Act 25 of 1956);

- medical scheme as defined in section 1(1) of the Medical Schemes Act, 1998 (Act 131 of 1998); or

- group scheme as contemplated in the Policyholder Protection Rules made under section 62 of the Long-term Insurance Act, 1998, and section 55 of the Short-term Insurance Act, 1998.

“Rejected” in relation to a complaint means that a complaint has not been upheld and the provider regards the complaint as finalised after advising the complainant that it does not intend to take any further action to resolve the complaint and includes complaints regarded by the provider as unjustified or invalid, or where the complainant does not accept or respond to the provider’s proposals to resolve the complaint.

“Reportable complaint” means any complaint other than a complaint that has been –

- upheld immediately by the person who initially received the complaint;

- upheld within the provider’s ordinary processes for handling client queries in relation to the type of financial product or financial service complained about, provided that such process does not take more than five business days from the date the complaint is received; or

- submitted to or brought to the attention of the provider in such a manner that the provider does not have a reasonable opportunity to record such details of the complaint as may be prescribed in relation to reportable complaints.

“Upheld” means that a complaint has been finalised wholly or partially in favour of the complainant and that

- the complainant has explicitly accepted that the matter is fully resolved; or

- it is reasonable for the provider to assume that the complainant has so accepted; and

all undertakings made by the provider to resolve the complaint have been met or the complainant has explicitly indicated its satisfaction with any arrangements to ensure such undertakings will be met by the provider within a time acceptable to the complainant.

Annexure B – Important Contact Details

FAIS Ombud

Postal Address FAIS Ombud, PO Box 74571, Lynwood Ridge, 0040

Telephone 012 762 5000 / 0860 663 247

Email [email protected]

Website www.faisombud.co.za

Long-term Insurance Ombudsman

Postal Address The Ombudsman for Long-term Insurance, Private Bag X 45, Claremont Cape Town, 7735

Telephone 021 657 5000 / 0860 103 236

Facsimile 021 674 0951

Email [email protected]

Website www.ombud.co.za

Short-term Insurance Ombudsman

Postal Address The Ombudsman for Short-term Insurance, PO Box 32334, Braamfontein, 2017

Telephone 011 726 8900 / 0860 726 890

Facsimile 011 726 5501

Email [email protected]

Website www.osti.co.za

Pension Fund Adjudicator (PFA)

Postal Address Pension Fund Adjudicator, PO Box 580, Menlyn, 0063

Telephone 012 346 1738 / 012 748 4000

Facsimile 086 693 7472

E-mail [email protected]

Website www.pfa.org.za

Ombudsman for Banking Services / Banking Adjudicator

Address The Ombudsman for Banking Services, 34-36 Fricker Road, Ground Floor, 34 Fricker Road, Illovo, Johannesburg

Telephone 011 712 1800 / 0860 800 900

Email [email protected]

Website www.obssa.co.za

4. Conflict of Interest Policy (COI)

- Introduction

In terms of the Financial Advisory and Intermediary Services Act, 2002, Capvest Wealth Management (Pty) Ltd (“the FSP”) is required to maintain and operate effective organisational and administrative arrangements with a view to taking all reasonable steps to identify, monitor and manage Conflict of Interest (“COI”). section 3A(2)(a) of the FAIS General Code of Conduct (“GCOC) stipulates that every financial services provider, other than a representative, must adopt, maintain and implement a Conflict of Interest Policy that complies with the provisions of the Act.

- Purpose

The purpose of this policy is to comply with these obligations and provide for mechanisms in place to identify, mitigate and manage the conflicts of interest to which the FSP is a party. In addition, to ensure alignment between the values of the organisation and the conduct of its people by safeguarding clients’ interests and ensuring the fair treatment of clients.

The FSP is committed to ensuring that all business is conducted in accordance with good business practice. To this end, the FSP conducts business in an ethical and equitable manner and in a way that safeguards the interests of all stakeholders to minimise and manage all real and potential conflicts of interest. Like any financial services provider, the FSP is potentially exposed to conflicts of interest in relation to various activities. However, the protection of our clients’ interests is our primary concern and so our policy sets out how:

- We will identify circumstances that may give rise to actual or potential conflicts of interest entailing a material risk of damage to our clients’ interests.

- We have established appropriate structures and systems to manage those conflicts.

- We will maintain systems in an effort to prevent damage to our clients’ interests through identified conflicts of interest.

To achieve the objectives set out above, this policy sets out the rules, principles and standards of the FSPs COI management procedures, by documenting them in a clear and understandable format.

- Scope of application

This policy is applicable to the FSP, all providers of the FSP, key individuals, representatives, associates and administrative personnel. The FSP is committed to ensuring compliance with this policy and the processes will be monitored on an ongoing basis.

Any non-compliance with the policy will be viewed in a severe light. Non-compliance will be subject to disciplinary procedures in terms of FAIS and employment conditions and can ultimately result in debarment or dismissal as applicable.

Avoidance, limitation or circumvention of this policy via an associate will be deemed non-compliance.

Capvest Wealth Management (Pty) Ltd is a private company. The registered name of the company is Capvest Wealth Management (Pty) Ltd, registration number 2009/021475/07.

The following wealth managers are licensed to provide clients with advice:

- Anton Meyer

- Stefan Smit

- Yzelle Reynolds

The wealth managers represent the following company as employees:

- Capvest Wealth Management (Pty) Ltd

We are an independent financial advisory business and not aligned with any bank, insurance company or investment house.

The director of Capvest Wealth Management (Pty) Ltd is as follows:

- Anton Meyer

The shareholders of Capvest Wealth Management (PTY) Ltd are as follows:

- Anton Meyer

There are seven people employed by Capvest Wealth Management (Pty) Ltd.

Life assurance companies or service providers with whom we do new business and administration:

- Momentum Life (Myriad)

- Old Mutual (Greenlight)

Life assurance companies for whom we provide administration services, but do not submit new business to:

- PPS

- Discovery

We do not directly hold more than 10% of an insurer or investment house’s shares.

We did receive more than 30% of our remuneration from Momentum (34% – 2018).

- Understanding Conflict of Interest

4.1 When is there a conflict of interest?

A COI means any situation in which the FSP or one of our representatives has an actual or potential interest that may, in rendering a financial service to our clients:

- Influence the objective performance of obligations to that client.

- Prevents us from rendering an unbiased and fair financial service.

- Prevents us from acting in the interests of that client.

An “actual or potential interest” includes but is not limited to:

- A financial interest, which includes any cash, cash equivalent, voucher, gift, service, advantage, benefit, discount, domestic or foreign travel, hospitality, accommodation, sponsorship, valuable consideration, other incentive or valuable consideration which exceeds R1 000 per calendar year.[1]

- An ownership interest which means any equity or proprietary interest and any dividend, profit share or similar benefit derived from that equity or ownership interest.

- Any relationship with a third party, meaning any relationship with a product supplier, other FSPs, an associate of a product supplier or an associate of the FSP. A third party also includes any other person who, in terms of an agreement or arrangement, provides a financial interest to the FSP or its representatives.

- An immaterial financial interest, which is any financial interest with a determinable monetary value, the aggregate of which does not exceed R1 000 in any calendar year from the same third party in that calendar year received by:

- A provider who is a sole proprietor; or

- A representative for that representative’s direct benefit;

- A provider, who for its benefit or that of some or all of its representatives, aggregates the immaterial financial interest paid to its representatives.

4.2 What type of interest may we give and receive?

The FSP and our representatives may only offer to and receive specific financial interests from a third party[2], which includes the following:

- Commission as authorised under the Long-term Insurance Act (52 of 1998), the Short-term Insurance Act (53 of 1998) and the Medical Schemes Act (131 of 1998).

- Fees as authorised under the Long-term Insurance Act (52 of 1998), the Short-term Insurance Act (53 of 1998) and the Medical Schemes Act (131 of 1998).

- “Other fees” specifically agreed to by the client and which can be stopped by the client at their discretion but only if agreed in writing with the client, including details of the amount, frequency, payment method and recipient of those fees, as well as the details of services to be provided in exchange for the fees.

- Fees or remuneration for services that were rendered to a third party.

- An immaterial financial interest.

- Any other financial interest not mentioned above for which a consideration, fair value or remuneration that is reasonably commensurate is paid by that provider or representative, at the time of receiving that financial interest.

4.3 On what basis may we give and receive financial interests?

The financial interests referred to in points 2, 3, and 4 above may only be offered or received by the FSP or its representatives, if:

- The financial interests are proportionate (reasonably commensurate) to the service being rendered, considering the nature of the service, the resources, skills and competencies that are reasonably required to perform it.

- The payment of those financial interests does not result in the FSP or representative being remunerated more than once for performing the same service.

- Any actual or potential conflicts between the interests of clients and the interests of the person receiving those financial interests are effectively mitigated.

- The payment of those financial interests does not impede the delivery of fair outcomes to clients.

4.4 Financial interests for representatives of the FSP

The FSP may not offer any financial interest to a representative of that FSP:

- For giving preference to a specific product of a product supplier, where a representative may recommend more than one product of that product supplier to a client.

- For giving preference to a specific product supplier, where a representative may recommend more than one product supplier to a client.

- That is determined with reference to the quantity of business, without also giving due regard to the delivery of fair outcomes for clients.

In relation to the delivery of fair outcomes for clients, the FSP must demonstrate that a determination of a representative’s entitlement to a financial interest, considers measurable indicators, relating to the:

- Achievement of minimum service level standards in respect of clients.

- Delivery of fair outcomes for clients.

- Quality of the representative’s compliance with the FAIS Act.

The measurable indicators are agreed upon in writing between the FSP and its representative and sufficient weight (significance) is attached to these indicators to materially mitigate the risk of the representative(s) giving preference to the quantity of business secured for the FSP over the fair treatment of clients.

The FSP does not offer a sign-on bonus[3] to any person, other than a new entrant[4], as an incentive to become a provider authorised or appointed to give advice.

The way in which the FSP remunerates its representatives and complies with these requirements is set out in section 6 of this policy.

- Processes and Internal Controls to Manage Conflict of Interest

5.1 Identification of conflict of interest

To adequately manage COI, the FSP must identify all relevant conflicts timeously. In determining whether there is or may be a COI to which the policy applies, the FSP considers whether there is a material risk of unfair treatment or bias for the client, taking into account whether the FSP or its representative, associate or employee:

- Is likely to make a financial gain, or avoid a financial loss, at the expense of the client.

- Has an interest in the outcome of a service provided to the client or of a transaction carried out on behalf of the client, which is distinct from the client’s interest in that outcome.

- Has a financial or other incentive to favour the interest of another client, group of clients or any other third party over the interests of the client.

- Receives or will receive from a person other than the client, an inducement in relation to a service provided to the client in the form of monies, goods or services, other than the legislated commission or reasonable fee for that service.

A conflict of interest often occurs and exists when there is a clash between professional responsibilities and personal (often material) interests.

In line with our COI Policy, possible and actual conflicts of interest or examples of conflicts of interest in our FSP are:

- Conflicts between the employee and the client.

- Conflict between service providers and the FSP e.g. receiving incentives.

- Close personal relationships.

- Gifts and entertainment.

Any COI:

- Between the FSP and external parties:

- Include a list of all associates; and

- Include a list of any third parties in which the FSP holds an ownership interest, or that a third party holds an ownership interest in the FSP.

- Between the FSP and the client.

- Between our clients if we are acting for different clients and the different interests conflict materially.

- Where associates, product suppliers, distribution channels or any other third party is involved in the rendering of a financial service to a client.

- Storing confidential information on clients which, if we would disclose or use, would affect the advice or services provided to clients.

All employees, including internal compliance officers and management, are responsible for identifying specific instances of conflict and are required to notify the key individual of any conflicts they become aware of. The key individual will assess the implications of the conflict and how the conflict should be managed, acting impartially to avoid a material risk of harming clients’ interests.

5.2 Measures for avoidance and mitigation of conflicts of interest

To ensure that the FSP can identify, avoid and mitigate COI situations, the FSP creates awareness and knowledge of applicable stipulations, through training and educational material. Where a COI situation cannot be avoided, these instances are recorded on the FSP’s conflict of interest register.

The FSP ensures the understanding and adoption of the FSP’s Conflict of Interest Policy and management measures by all employees, representatives and associates through training on the COI Policy.

The key individual will assess each conflict, including whether the conflict is actual or perceived, what the value of the conflict or exposure is and the potential reputational risk. Compliance and management then agree on the controls that need to be put in place to manage the conflict. Once a conflict of interest has been identified it needs to be appropriately and adequately managed and disclosed, in line with the below steps.

5.3 Measures for mandatory disclosure of conflicts of interest

Where there is no other way of managing a conflict, or where the measures in place do not sufficiently protect clients’ interests, the conflict must be disclosed to allow clients to make an informed decision on whether to continue using our service in the situation concerned.

In all cases, where appropriate and where determinable, the monetary value of non-cash inducements will be disclosed to clients. The key individual will ensure transparency and manage conflict of interests. The client must be informed of the Conflict of Interest Policy and where they may access the policy.

5.4 Ongoing monitoring of conflicts of interest management

The key individual or staff member in charge of supervision and monitoring of this policy will regularly monitor and assess all related matters. The FSP will conduct ad hoc checks on business transactions to ensure the policy has been complied with.

The compliance officer will include monitoring of the Conflict of Interest Policy as part of his or her general monitoring duties and will report thereon in the annual compliance report.

This policy shall be reviewed annually and updated if applicable. The compliance function is outsourced to an external compliance company with no shareholding in this FSP. The compliance practice functions objectively and sufficiently independently of the FSP and monitors the process, procedures and policies that the FSP has adopted to avoid conflicts of interest.

5.5 Training and staff

Comprehensive training on the Conflict of Interest Policy is provided to all employees and representatives as part of specific and/or general training on the FAIS Act and GCOC.

Training will be incorporated as part of all new appointees’ induction. Ongoing and refresher training on the FSP’s Conflict of Interest management processes and Policy is provided on an annual basis.

5.6 Registers

With regard to existing third-party relationships, being the product suppliers listed in our Contact Stage Disclosure letter, we confirm that there are no circumstances which could lead to a potential conflict of interest. Should any conflicts arise with regard to any of these, prior to entering into any business transaction with you, we undertake to disclose these in the registers below.

All gifts, financial interest, immaterial financial interest and any other COI situations as outlined in this policy, must be recorded in the FSP’s COI register.

6, Remuneration Policy

This section of the policy specifies the type of and the basis on which a representative of the FSP will qualify for a financial interest that the FSP offers and motivates how that financial interest complies with the requirements of this policy.

Remuneration within Capvest Wealth Management (Pty) Ltd is aligned to corporate strategy and in adherence to principles of good corporate governance, as depicted in “best practice” and regulatory frameworks (e.g. King IV) and with the requirements of the Companies Act (2008).

The Remuneration Policy of Capvest Wealth Management (Pty) Ltd is to promote and support positive outcomes across the economic and social context in which the company operates and to promote an ethical culture and responsible corporate citizenship.

The company’s remuneration philosophy is to recruit, motivate, reward and retain employees who believe in, and live by, our culture and values. We are creating a working environment that motivates high performance so that all employees can positively contribute to the strategy, vision, goals and values of the business.

Principles

- The Remuneration Policy is informed by the following principles, which are aligned with the concept of Total Remuneration for staff.

- Total Remuneration includes the components of:

- Commission; and/or

- Asset based fees;

- Guaranteed pay and benefits; and

- Performance-variable pay (short-term incentives), with an appropriate ‘pay mix’ designed to achieve a balanced focus on achievable organisational goals and personal objectives in each case.

The two guiding principles are as follows:

- Guaranteed remuneration packages are aligned to our performance-oriented philosophy.

- Short-term incentives reward high-performing employees for their performance contribution to the group, divisional cluster and division in which they work. Key team or individual performance metrics are based on a scorecard of economic, social and environmental targets.

Remuneration structure

The remuneration structure is made up of the three components of Total Remuneration:

- Commission and asset-based fees: mostly structured for representatives in the business that give advice and intermediary services.

- Total Guaranteed Package (TGP): incorporating basic pay, leave and other e.g. UIF.

- Short-Term Incentives (STIs): performance-based bonuses that are dependent on

company and individual performances during the particular financial year.

Also take note of the following:

Investments

- Generally, no initial fee.

- Ongoing advice fee as arranged with the client (signed agreement). Annual advice fee as a percentage of assets. Fees confirmed by the client are paid by the product provider to the FSP.

Risk cover

Upfront commission paid by the product provider (this is a small percentage of CWM business).

Draft of documents

As per agreement with client.

Client quoted by the FSP or outsourced to product provider.

General

As per agreement with the client.

The costs of drafting wills, liaising with auditors, trust services etc. are generally included in the ongoing fee that a client pays.

Renewal of fees

Some investments require renewal of fees e.g. retirement annuities that were established via section 14 transfer.

We are independent financial advisors who do not receive additional fees or financial interests from service providers. We strive to deliver fair outcomes to clients.

The FSP carries out regular inspections on all commissions, remuneration, fees and financial interests proposed or received in order to avoid non-compliance.

All income is audited monthly and annually by the key individual as well as the FSP’s auditor. Annual financial statements are submitted to the FSCA.

‘

This, for example, includes but is not limited to:

- Analysis of management information to identify trends and outliers

- TCF client feedback programme results, assessments and reviews

- Compliant trend analysis

- Registers

With regard to existing third-party relationships, being the product suppliers listed in our Contact Stage Disclosure Letter, we confirm that we do not have an ownership interest or are subject to exclusive training nor are there any other circumstances that could lead to a potential conflict of interest. Should any conflicts arise with regard to any of these prior to entering into any business transaction with you we undertake to disclose these in the registers below.

Capvest Wealth Management (Pty) Ltd has implemented the following registers:

- Nature and extent of ownership interests

- Financial interest received

- Nature and extent of business relationships

- Associations

- Additional Definitions

Associate

(a) In relation to a natural person, means:

- A person who is recognised in law or the tenets of religion as the spouse, life partner or civil union partner of that person;

- A child of that person, including a stepchild, adopted child and a child born out of wedlock;

- A parent or stepparent of that person;

- A person in respect of which that person is recognised in law or appointed by a court as the person legally responsible for managing the affairs of or meeting the daily care needs of the first-mentioned person;

- A person who is the spouse, life partner or civil union partner of a person referred to in subparagraphs (ii) to (iv);

- A person who is in a commercial partnership with that person.

(b) In relation to a juristic person:

- Which is a company, means any subsidiary or holding company of that company, any other subsidiary of that holding company and any other company of which that holding company is a subsidiary;

- Which is a close corporation registered under the Close Corporations Act, 1984 (Act No. 69 of 1984), means any member thereof as defined in section 1 of that Act;

- Which is not a company or a close corporation as referred to in subparagraphs (i) or (ii), means another juristic person which would have been a subsidiary or holding company of the first-mentioned juristic person:

- Had such first-mentioned juristic person been a company; or

- In the case where that other juristic person, too, is not a company, had both the first-mentioned juristic person and that other juristic person been a company.

- Means any person in accordance with whose directions or instructions the board of directors of or, in the case where such juristic person is not a company, the governing body of such juristic person is accustomed to act;

(c) In relation to any person:

- Means any juristic person of which the board of directors or, in the case where such juristic person is not a company, of which the governing body is accustomed to act in accordance with the directions or instructions of the person first-mentioned in this paragraph;

- Includes any trust controlled or administered by that person.

Fair value

Has the meaning assigned to it in the financial reporting standards adopted or issued under the Companies Act, 61 of 1973.

FSC

Means the Financial Sector Code published in terms of section 9(1) of the Broad-Based Black Economic Empowerment Act, (Act 53 of 2003), as amended from time to time.

Distribution channel means

- Any arrangement between a product supplier or any of its associates and one or more providers or any of its associates in terms of which arrangement any support or service is provided to the provider or providers in rendering a financial service to a client.

- Any arrangement between two or more providers or any of their associates, which arrangement facilitates, supports or enhances a relationship between the provider or providers and a product supplier.

- Any arrangement between two or more product suppliers or any of their associates, which arrangement facilitates, supports or enhances a relationship between a provider or providers and a product supplier.

New entrant

Is a person who has never been authorised as a financial services provider or appointed as a representative by any FSP.

No-claim bonus means

Any benefit that is directly or indirectly provided or made available to a client by a product supplier in the event that the client does not claim or does not make a certain claim under a financial product within a specified period of time.

Measured entity

Has the meaning assigned to it in the FSC insofar it relates to a qualifying enterprise development contribution.

Qualifying beneficiary entity

Has the meaning contemplated in the FSC insofar as it relates to a qualifying enterprise development contribution.

Qualifying enterprise development contribution

Has the meaning assigned to it in the FSC.

Sign-on bonus means

- Any financial interest offered or received directly or indirectly, upfront or deferred, and with or without conditions, as an incentive to become a provider; and

- A financial interest referred to in paragraph (a) includes but is not limited to:

Compensation for the:

- Potential or actual loss of any benefit including any form of income, or part thereof; or

- Cost associated with the establishment of a provider’s business or operations, including the sourcing of business, relating to the rendering of financial services.

A loan, advance, credit facility or any other similar arrangement.

5. Treating Customers Fairly Policy (TCF)

Our Treating Customers Fairly Policy is centered around guidelines provided by the FSCA’s board to ensure we consistently deliver fair outcomes to our clients and take responsibility for the business and staff, providing an enhanced service quality to clients, based on a culture of openness and transparency. As a business, we take the requirements of the FSCA seriously – the requirement to treat customers fairly. The Regulator has introduced the six drivers of treating clients fairly. Capvest Wealth Management (Pty) Ltd (Capvest) is bound and supports these outcomes:

Outcome 1: Customers are confident that they are dealing with firms where the fair treatment of customers is central to the firm culture. We believe in people growth, knowledge sharing, training, by doing so we will gain and improve customer confidence.

Outcome 2: Products and services marketed and sold in the retail market are designed to meet the needs of identified customer groups and are targeted accordingly. We follow the financial planning guidelines and monitor, measure and control activities of representatives accordingly.

Outcome 3: Customers are given clear information and are kept appropriately informed before, during and after the time of contracting. Various activities are performed in the business to ensure clear information is given to clients in a structured manner through various communication channels. Our Conflict of Interest Policy is available and communicated to all staff. Each individual staff member has an employee contract which includes client confidentiality and data integrity, and they must adhere to it. Policies and procedures such as claims, complaints and reviews are available for staff members and we ensure it is regularly emphasised in the business.

Outcome 4: Where customers receive advice, the advice is suitable and takes account of their circumstances.

Outcome 5: Customers are provided with products that perform as firms have led them to expect, and the associated service is both of an acceptable standard and what they have been led to expect.

Outcome 6: Customers do not face unreasonable post-sale barriers to change product, switch provider, submit a claim or make a complaint.

These outcomes serve the FSCA’s three intermediate outcomes: Improved customer confidence, appropriate products and services and enhanced transparency and discipline.

Capvest has built these outcomes into their business processes to improve client service and understanding.

6. The Protection of Access to Information Act (PAIA)

PAIA manual

An authorised financial services provider regulated by the Financial Services Board, FSP Number 41026

Registration Number of Company: 2009/021475/07

Name of company: Capvest Wealth Management (Pty) Ltd

MANUAL

in terms of

section 51 of

The Promotion of Access to Information Act